Know how much Dear Lottery tax is cut from your prize in India! Learn the rules, tax rates, and safe steps to get your winning money.

It is like a dream to win the Dear Lottery but wait! Before you begin to think over what to purchase. You should bear in mind that the government, too, makes a deduction on your prize in the form of a duty. We can speak plainly of the amount of tax you save on your Dear Lottery winnings and of its consequences to you.

Why Lottery Winnings Are Taxed

Under the Indian income tax act, the money received by winning a lottery is subject to income tax as the income of other sources. That is not free cash after all your winning. It will be treated as taxable income, like a salary or business income. This is done to make sure that things are fair and clear to the government. It facilitates avoiding false claims. All cases of major winnings are registered with the authorities.

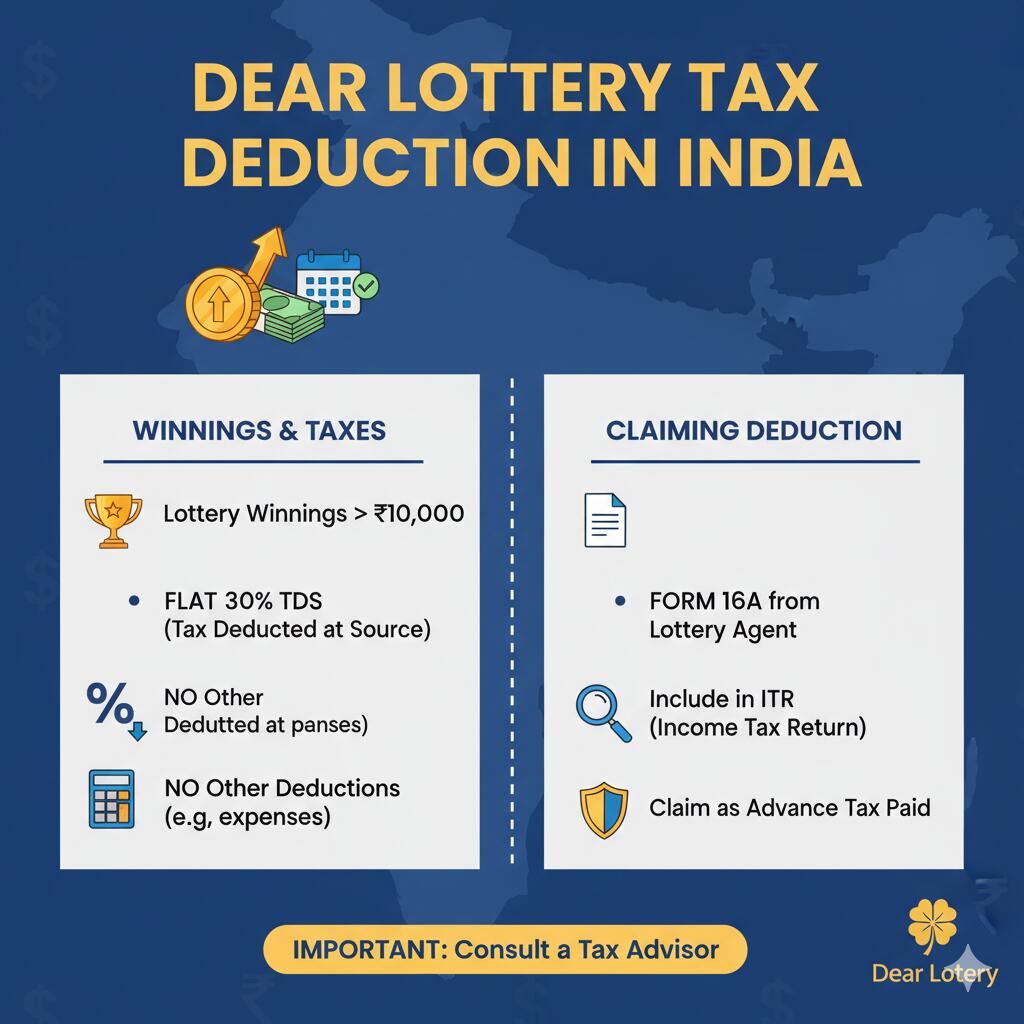

How Much Tax Is Deducted

In India, lots of 30% are deducted on lottery winnings such as Dear Lottery prizes. This is a fixed rate that does not vary according to the amount.

Example:

- If you win ₹1,00,000 → ₹30,000 goes as tax.

- If you win ₹10,00,000 → ₹3,00,000 goes as tax.

This deduction takes place before you get the prize money. The remaining amount then comes after tax.

TDS (Tax Deducted at Source)

The Dear Lottery office takes out 30% tax (TDS) before giving you your prize money. You don’t have to visit any tax office. The lottery team does it for you. When the tax is removed the lottery people leave you with the remaining money. They could also give you a little piece of paper (it is known as a TDS certificate) on which they tell you how much tax they retained.

Extra Charges (Surcharge & Cess)

In addition to the primary 30 percent tax, there are small additional taxes that are termed as surcharge and cess. These increase the overall tax to a slight extent of 31.2. The difference is not so solid. But it is better to know it prior to planning your prize!

Can You Get a Refund on This Tax?

No, you can’t. Lottery winnings are taxed at 30 percent, on a final and non-refundable basis. This tax will not decrease or pay back even in cases that your annual total income is low. The government lists the lottery income as an additional income to your regular earnings.

Example in Simple Words

Let’s say Meena wins ₹10 lakh from Dear Lottery.

Here’s what happens:

- Prize money: ₹10,00,000

- Tax @30%: ₹3,00,000

- She receives: ₹7,00,000

That’s it! She doesn’t have to pay any more tax later.

Who Cuts and Pays the Tax?

The tax deduction is done by the State Lottery Department or an authorized lottery distributor. They cut it and pay the prize first. And then deposit it directly at the Income Tax Department on your behalf. In this manner, you are totally safe and legal.

When You Should File Your Return

Although TDS is already deducted. Your lottery income should still be mentioned when you are filing your annual income tax return. It demonstrates that your prize money was not illegal. It was duly taxed which leaves your record clean.

Tips to Remember

- You must always pick your TDS certificate in the lottery office.

- Always use official means to claim your prize and not through unknown persons.

- Carry a copy of your winning ticket, ID proof and claim form.

- Only place your prize money on your own bank account.

Final Thoughts

It is fun to win the Dear Lottery but it is better to know the tax side. So keep in mind 30 percent of your prize is taxed, and the rest is yours indeed. Play safe, be honest in taking your winnings, and enjoy your win proudly because even after tax, a Dear Lottery win can still make your day shine!